A COMEBACK OF 1990-Recession?-The exclusive prediction of Fitch Ratings

Table of Contents

- 1 A COMEBACK OF 1990-Recession?-The exclusive prediction of Fitch Ratings

- 1.1 What is the Recession?

- 1.2 Why do Recessions Happen?

- 1.3 What are Recession Predictors and Indicators?

- 1.4 The difference between Recession and Depression

- 1.5 What happens in a recession?

- 1.6 How long do recessions last?

- 1.7 Notable Recession and Depressions

- 1.8 When was the last recession or depression?

- 1.9 Can recessions have long-term effects?

- 1.10 The recent predictions of a Recession-

Fitch Ratings Firm has predicted a comeback of the 1990-Recession. It predicts a 1990-style Mild Recession in the next Spring!

According to the report, the strong labor markets will cushion the blow of the recession, but the interest rate hikes and soaring inflation will consequently result in a slowdown the Job Growth. It also predicts that consumer spending to grow by 2.5% this year before slowing down to 0.9% in 2023. It says the US economy will witness a recession in 2Q23 although relatively mild than the historical standards.

The prediction is similar to the 1990s recession, which led to Fed tightening in 1989-1990 and raising the interest rates. The Fitch Rating sees the unemployment rate rising from just 3.5% today to a peak of 5.4% in 2024.“Downside risks stem from nonfinancial debt-to-GDP rations, which are much higher now than in the 1990s,” Olu Sonola, head of U.S. Regional economics for Fitch.

Despite the rising recession buzz, the job market is tight with an unbalanced flow of supply and demand of labor.

Let us understand the concept of the Recession.

What is the Recession?

- There has been no official definition of the Recession, but there’s a common understanding that it is a period of decline in the output of an economy. An economy is all about how a nation produces and consumes goods and services over a period of time and the quality of goods and services. An economy shows how a nation would earn or spend money. Thus a recession occurs when the nation’s producing and consuming capacity witnesses a slowdown.

- The output of an economy usually witnesses fluctuations of growth (alternating phases of contractions and expansions) which can be termed the “Business Cycle”. Recession is thus usually referred to as the contraction/trough of the “Business Cycle”. It can be also termed a massive slowdown in economic activity.

- Most analysts also define it as two consecutive quarters of decline in a country’s real (inflation-adjusted) gross-domestic-product (GDP) -the value of all goods and services a country produces. This definition has usually used as a rule of thumb, but it is not a precise definition. GDP alone cannot be taken as a measure of economic activity to define whether a nation is undergoing a recession.

- The National Bureau of Economic Research (NBER) in the US is a firm that maintains a chronology of the beginning and end dates of the recession in the US. It uses a broader definition of recession and uses various measures of economic activity to define the start and end dates of a recession.

- According to the Business Cycle Dating Committee of the NBER, a recession is a “significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators. A recession begins when the economy reaches a peak of activity and ends when the economy reaches a trough.”

- Thus the firm focuses on a comprehensive set of measures along with GDP, like employment, income, sales, and industrial production to determine and analyze the trends in economic activity

Why do Recessions Happen?

Understanding the sources of recession has been the key area of research in economics. There can be a variety of reasons why recessions take place. It can be a long-term outcome or a short-term visible factor that can constitute a recession. Some examples can be-

A structural shift in industries can result in economic changes. A steep increase in Oil prices, which can affect the overall increase in prices can be an indicator of a Recession.

Financial factors can contribute to the economy’s fall into recession. One such case was the 2007-2008’s U.S. Financial Crisis. The overextension of credit and debt on risky loans and marginal borrowers can result in huge risks in the financial sector.

The expansion of the supply of money and credit in the economy by the Federal Reserve and the banking sector can drive this process to extremes, stimulating risky asset price bubbles. As corporations and households start facing difficulties in meeting their debt obligations, they reduce investment and consumption which in turn reduce economic activity.

A recession can also be triggered by stern monetary and fiscal policies aiming to reduce inflation. When such stern policies are used in excess, they can lead to a decrease in demand for goods and services, which can ultimately lead to recession.

Recessions can be the result of a decline in external demands, especially in countries with strong export sectors. Poor tourist trade during the Covid pandemic had been one of the contributors to the prevailing economic crisis in Sri Lanka.

The COVID Pandemic and the strict public health restrictions to prevent its spread had also been an economic shock that can precipitate a recession. It may also be the case that an economic shock merely accelerates the start of a recession that would have happened anyway as a result of other economic factors and imbalances.

There are several economic theories as well that try to define why a recession can happen. These theories are broadly divided into economic, financial, or psychological factors.

What are Recession Predictors and Indicators?

While there are no single foolproof recession predictors or indicators, an inverted yield curve has been highly effective in predicting each of the 10 economic recessions of the U.S since 1955(there had been some false alarms as well).

Investors use Leading Indicators to forecast future economic activity and hence to anticipate future economic turning points. Some examples of such leading indicators are ISM Purchasing Managers Index, the Conference Board Leading Economic Index, and the OECD Composite Leading Indicator.

The difference between Recession and Depression

Similar to the recession, there is no single definition of depression. We can define it as a much bigger version of recession in terms of scale and duration.

Most analysts consider a depression to be an extremely severe recession in which the decline in GDP exceeds more than 10%.

What happens in a recession?

There have been 122 recessions in 21 advanced economies over the period 1960-2007. This seems like a lot, but recessions do not usually happen. In fact, the proportion of time spent in recession measured by the no of quarters a country was in recession over the full sample period was typically about 10 percent. (source: imf.org)

Each recession has some uniqueness, but there are also some common characteristics that they exhibit. They are as follows-

They typically last about a year and often result in a significant output cost. In particular, a recession is usually associated with a decline of 2 percent in GDP. In the case of severe recessions, the typical output cost is close to 5 percent.

A recession mainly affects economic output, employment, and consumption.

The fall in consumption is often small, but both industrial production and investment register much larger declines than that in GDP.

They typically overlap with drops in international trade as exports and, especially, imports fall sharply during periods of slowdown.

The unemployment rate almost always jumps and inflation falls slightly because overall demand for goods and services is curtailed. Along with the erosion of house and equity values, recessions tend to be associated with turmoil in financial markets.

Interest rates are likely to decline as the central bank (the Federal Reserve in the U.S.) cuts its benchmark rate to support the economy. The government’s budget deficit widens because tax revenues tail-off, while spending on unemployment insurance and other social programs rises as more people qualify for the benefits.

How long do recessions last?

As stated earlier the recession typically lasts over a year. The average U.S. Recession since 1857 lasted 17 months, while the six recessions since 1980 have lasted less than 10 months on average.

Notable Recession and Depressions

Recessions

As per the IMF, a global recession is a “Decline in annual per capita real world GDP( purchasing power parity weighted) backed up by a decline or worsening for one or more of the seven other global macroeconomic indicators: industrial production, trade, capital flows, oil consumption, unemployment rate, per-capita investment, and per-capita consumption.”

Accordingly, the world economy has witnessed four global recessions over the past seven decades in 1975,1982,1991, and 2009.

The 2009 global recession, set off by the global financial crisis, was by far the deepest and most synchronized of the four recessions.

For the US, it was an 18-month-long recession from December 2007 to June 2009. The country had witnessed the deepest decline of 3.7%in output since 1960.

Depressions

- The General Crisis of 1640-The Ming Province of China went bankrupt and the Stuart Monarchy was in the civil war on three fronts in Ireland, Scotland, and England during the time.

- The Great Depression of 1837-This great depression ended in the United States due to the California Gold Rush and its ten-times addition to the United States gold reserves. As with most great depressions, it was followed by a thirty-year period of a booming economy in the United States, which is now called the Second Industrial Revolution (of the 1850s).

- The Panic of 1837-The Panic of 1837 was an American financial crisis, built on a speculative real estate market. The bubble burst on 10 May 1837 in New York City, when every bank stopped payment in gold and silver coinage. The Panic was followed by a five-year depression, with the failure of banks and record-high unemployment levels.

- Long Depression-Starting with the adoption of the gold standard in Britain and the United States, the Long Depression (1873–1896) was indeed longer than what is now referred to as the Great Depression, but shallower in some sectors. Many who lived through it regarded it to have been worse than the 1930s depression at times. It was known as “the Great Depression” until the 1930s.

- The Great Depression-The Great Depression of the 1930s affected most national economies in the world. This depression is generally considered to have begun with the Wall Street Crash of 1929, and the crisis quickly spread to other national economies. Between 1929 and 1933, the gross national product of the United States decreased by 33%, while the rate of unemployment increased to 25% (with industrial unemployment alone rising to approximately 35% – U.S. employment was still over 25% agricultural).

- The Greek Depression-Beginning in 2009, Greece sank into a recession that, after two years, became a depression. The country saw an almost 20% drop in economic output, and unemployment soared to nearly 25%. Greece’s high amounts of sovereign debt precipitated the crisis, and the poor performance of its economy since the introduction of severe austerity measures has slowed the entire Eurozone’s recovery. Greece’s continuing troubles have led to discussions about its departure from the Eurozone.

When was the last recession or depression?

In 2020, the COVID pandemic lockdowns and strict government norms to prevent the spread drove the global economy into recession, the second-largest recession in recent history.

Can recessions have long-term effects?

The social and economic costs of recession are usually large and persistent. A long-term consequence occurs due to unemployment and business failures during the recession. Some people face long-term unemployment even after the recession ends.

Many structural shifts during a recession focussing on stabilizing the economy also impact long-term unemployment. Thus, the unemployment rate after each recession is much higher than before the economy enters a recession and it takes a long time to decline. The rise in unemployment results in hardships, in society, affecting different groups in different recessions.

A long-term effect is witnessed in health, learning, achievement of qualifications, and social mobility in recession struck societies. The business failures that occur during a recession result in a permanent loss of output and destruction in productive capacity. A recession can also have a longer-term impact on a nation’s public debt as governments experience a reduction in taxation revenue but need to fund increased expenditure and transfer payments (through their efforts to stimulate the economy, provide social welfare, and support businesses).

The recent predictions of a Recession-

Many economists are expecting economic growth to slow in 2023. Fitch Ratings predicts it as a 1990-style Mild recession in the next Spring.

Third quarter real Gross Domestic Product (GDP) rose by 2.6%, according to data released by the U.S. Bureau of Economic Analysis. This was higher than the consensus estimate of 2.4% and follows two consecutive quarters of GDP contraction.

According to Steve Hanke, Professor of Applied Economics at Johns Hopkins University, the recession is still likely and his estimate of probability is 90%.

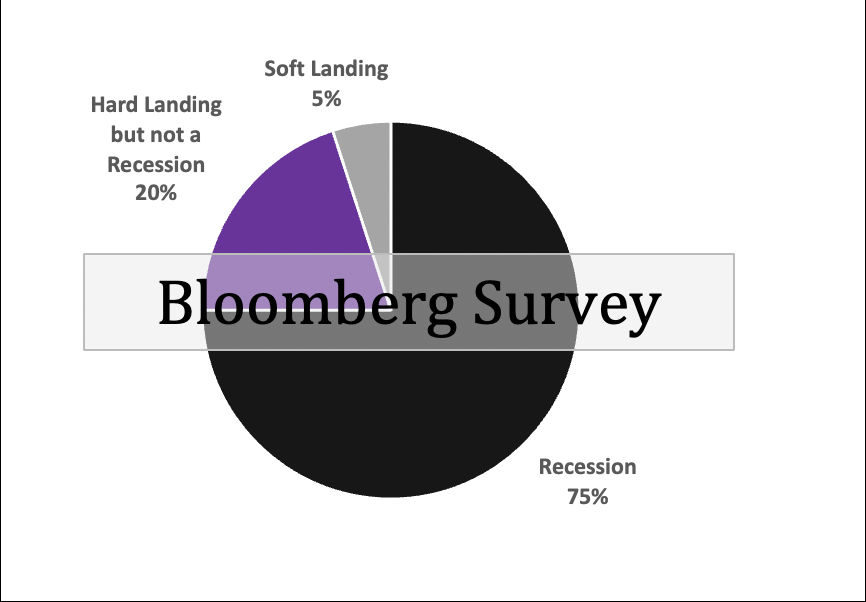

According to Bloomberg, Three-Quarters of Economists Expect a US Recession

A hard landing is defined as zero or negative growth for a time, but not an officially declared recession. Amazon.com Inc. has joined a chorus of Big Tech firms that have disappointed investors this week by forecasting a slowdown in sales growth for the all-important holiday season and warned of a hit to consumers’ purchasing power.

Consequently, US stock index futures have tumbled with the gloomy recession forecasts of Mega Caps Amazon, and Apple Inc. as the Federal reserves, and aggressive interest rates are slowing down the economy and will be affecting corporate earnings.